Stacked imbalances – Do they stack up?

Pun, intended…

So, order-flow stacked imbalances. Every YouTube video and furu currently seems to be talking about them. Do they stack up?

Before we begin. This is order flow-related material. If you are a bare candle fanatic, that’s fine – Just skip this entire article! I promise I will not hold it against you.

So, what IS a stacked imbalance? Well, it’s typically an overwhelming amount of volume driven by buyers or sellers in one direction, usually, quickly. It is basically a shotgun that tends to clear a path in a certain direction. Here is an example of one highlighted, up close, using a ladder view. Note the bright green numbers stacked on top of each other on the buy side – hence the name. Simple, right? You’ll note there is typically little volume on the sell side – This happens when a large amount of orders on one side tends to sweep the book quickly – no one gets a chance to execute anything else!

I recently added some new options to my pjsProfileBars indicator, for Ninjatrader 8. Whilst imbalances were already detected and highlighted, I decided to improve that functionality. I also added ‘stacked’ imbalance detection with a range of parameters for filtering those imbalances. And, what better way to get some statistics on these setups, than to add trigger support to the algo helper so I can automate some backtesting 🙂

Here is a screenshot of the latest development build in testing

The algo helper is the button row across the top left of the screen that allows you to set various long/short triggers on different signals to automatically trigger trade entries.

So what did we test? I set some parameters for the amount of volume, number of imbalances, tolerances, etc., with a single contract using a fixed ATM 80 tick profit, 92 tick stop (just under 1:1). This was an arbitrary choice. I thought it would be close enough to work. The test is run on the Nasdaq in tick replay. This gives as close to real-life as is possible with Ninjatrader (and tests the software!). I chose to trade longs only, because this type of setup is typically a trend-following setup (it can also be regression, but not finished coding that yet!), and, well – Nasdaq is certainly in an uptrend at the moment. I let every trade execute from stop to target, without any manual intervention. Trades were only closed when the target or stop was hit.

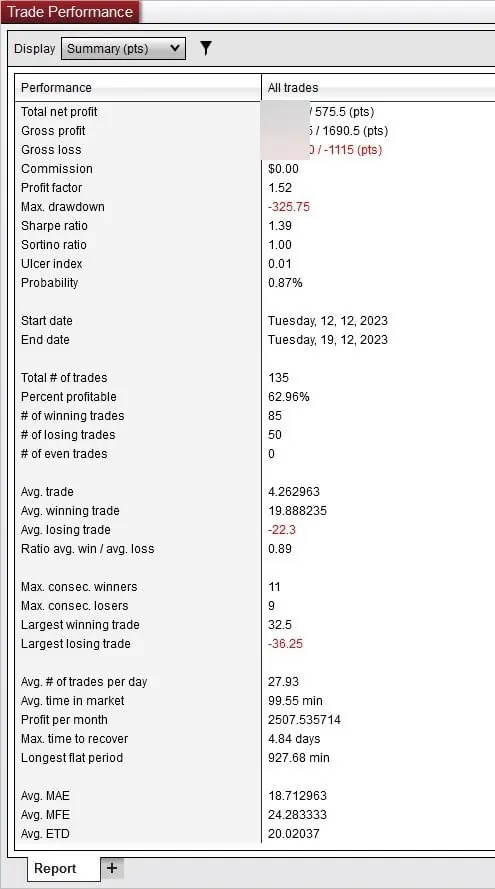

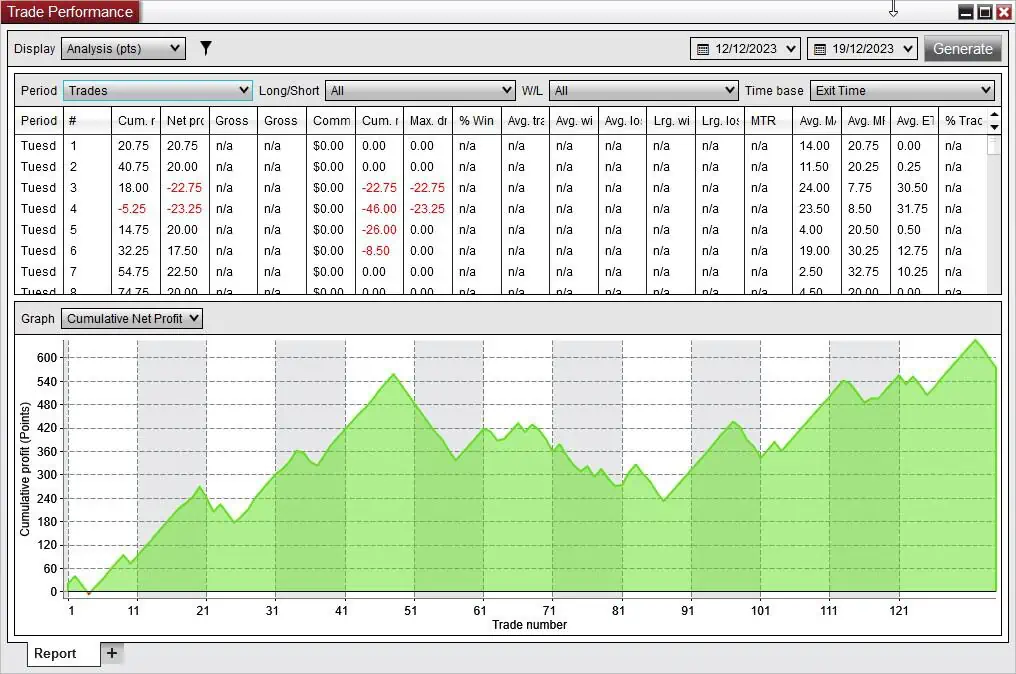

Here are the results for the last week

Conclusion – Small test, but encouraging! Certainly better than the majority of the first attempt, simplified backtests I do. Lots more testing on both code and results to do, but I would certainly say these are something to pay attention to. Additional filters for when price is at the top or bottom of a swing etc., will certainly be worth looking into, though for the most part, the algo functions in the app used here are not intended for full auto use! This strategy would almost certainly enhance other strategies as an additional criterion or weight for entry.

Do you trade these? Do you have any comments regarding implementation in the software? I would love to hear your feedback.

Merry Christamas all.

Hi thank you for your article. Is the stack imbalance fx available to download?

Hi Paul

I’m looking at something manually using the cumm delta of a pullback swing and using the %Bull/Bear indicator from your Heiken Ashi indicator on various TimeFrames as confluence.

I was hoping to find something like this as a further confluence so this could be useful.

Have you taken this any further than this test?

All the best, William

Hi,

I have been watching them the last few months. I do believe they have found a firm place in my trading. Still figuring some things out, but, yes – I would say they are quite valuable. The bar imbalances, as a whole, too.

–

Paul